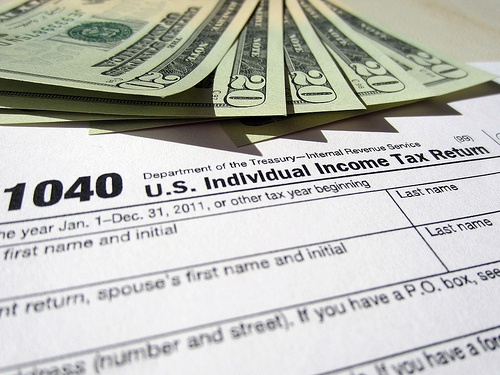

Do not sign your tax returns without speaking with your NJ divorce attorney first.

It is surprising how many people who consult with me label their spouses "control freaks."

Many people, usually (but not always) women, find themselves in marriages where they have become used to doing what their spouse tells them what to do, especially when it comes to finances.

Indeed, this is the time of year when husbands sometimes try to unfairly control their wives into signing tax returns that the wives have not yet read, only to then try to use the fact that the wife signed the tax returns against her in the divorce case.

The issue is what do you do the middle of April when suddenly your estranged spouse puts tax returns in front of you and tells you to sign on the dotted line without first giving you a fair amount of time to review the tax returns first?

Pennsylvania divorce lawyer Mark Ashton wrote a post about this phenomenon:

If you sign the return that is being handed to you at the last second, know that you are stating under oath that the information is accurate on the return and that you agree that you owe any money due in connection with the return. It also means that you owe any money the IRS decides is due after they finish having their way with the return.

So what can you do to protect yourself if this happens to you? Ashton suggests a few creative options:

...you can tell your spouse that you will agree to jointly file for an extension. The extension runs to October 15 and to be valid must be accompanied by any payment due.

You can file separately. This actually may be best because a married separate return can be amended to a joint return after you have had a chance to review the return with a lawyer or accountant of your choosing. You can also file an extension separately. In that way you are not committing to a joint return until you have a chance to look.

The separate return or the extension are scary in their own right mainly because you know that failing to sign the return is going to make your spouse VERY ANGRY. It’s a pretty common ploy and people are not always at their best during tax season anyway.

But I think that his concluding paragraphs are the most powerful:

The real answer is to write an email to your spouse this weekend. “Dear Spouse. It’s about to be the second week of April. If you are expecting me to sign a joint return I need time to look at it. If I don’t have the return to look at by Wednesday, April 13, 2023, I’ll arrange to file separately or file for an extension. That’s only fair.

I endorse Ashton's recommendation that you sent this email or letter, and I think you should do it today if you have not yet signed your tax returns.

You are going through a divorce. You may feel that your spouse is a "control freak."

Remember that you do not have to blindly follow your spouse's demands on any issue, including issues related to the filing of your tax returns.

IF THIS ARTICLE WAS HELPFUL, THEN LET ME HELP YOU CONTINUE YOUR DIVORCE EDUCATION

I'll teach you how to protect yourself.

You'll learn how to make a fair deal.

I've written hundreds of brief articles, just like this one, on New Jersey specific divorce-related topics.

If this article was useful to you, then I want you to know that there are hundreds more articles just like these that I will share with you at no cost!

Just enroll in STEVE KAPLAN'S DIVORCE COURSE.

It takes under 10 seconds to enroll.

When you sign up, you'll immediately receive a powerful article called "Steve Kaplan's Guide To Divorce In New Jersey".

This article is an easy read that takes you through the entire New Jersey divorce process in under 10 minutes.

I cannot tell you how many people have told me that this article has helped them make better divorce-related decisions that led them to a favorable divorce settlement.

It will help you, too, as will all of the other brief, easy to understand articles that I will send to you, one each day.

Start your free subscription to STEVE KAPLAN'S DIVORCE COURSE right now...you'll be so glad that you did!

I cannot wait to start helping you get the "edge" in your New Jersey divorce case!

Until next time,

Steve

Steven J. Kaplan, Esq.

Specializing In Divorce

Throughout New Jersey

5 Professional Circle

Colts Neck, NJ. 07722

www.KaplanDivorce.com

(732) 845-9010